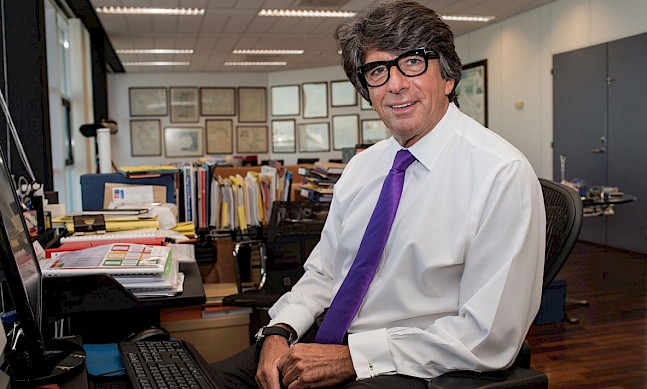

The only lawyer in Gibraltar to have been rated ‘Star performer’ by Chambers & Partners and Legal 500 for three years in a row, James Levy was awarded a CBE in 2013 for his service to the economy and community of Gibraltar after playing a vital role in the development of the jurisdiction as a finance centre. This included advice on anti-money laundering, banking, insurance, financial services and trust legislation. He spoke to The Report Company about the role Gibraltar’s legal profession has played in the growth of the territory’s economy.

The Report Company: How did you start out in law in Gibraltar?

James Levy: I started in 1972 but the firm’s founder, Sir Joshua Hassan, started much earlier. The firm is 75 years old this year. When I started, we had two rooms and a kitchen, a part-time secretary and a clerk, and we started developing the practice together, Sir Joshua and I. His name was very prestigious and he always had good clients, but he wasn’t able to give them time because he was in politics.

I made up my mind, with Sir Joshua’s consent, that we would not be a family firm; that we would be the first firm that would attract people on merit and not because of their family connections, so we were the first people to have partners not of the family. Now, Sir Joshua was my uncle, my mother’s brother, so I’m family, but then Tony Provasoli who came after me was not a member of the family, and he was the first person in Gibraltar not of a family to be made a partner of a family firm, and so it went. Therefore we attracted a lot of talent. We attract everybody who wanted to be a partner and who was ambitious and felt that Hassans was his or her home because they could develop to become a partner.

TRC: Did Gibraltar already had a legal services history when you started?

JL: Yes, and other firms have been doing work for a very long time. We used to do a bit of work for Shell when I started, 43 years ago. We did a lot of work for Taylor Woodrow, a lot of work for ABN Bank and other firms used to do international work too, so that’s how we started.

TRC: You were awarded the CBE for your initiatives, such as assisting the government of Gibraltar in the development of the jurisdiction as a financial centre. What can you tell us about this?

JL: The first thing was that when I started advising the government of Joe Bossano in 1988, Gibraltar was over 120 directives behind in the implementation of EU directives. The government was under huge pressure from the British government because the European Commission were going to start infraction proceedings against them. I advised the Gibraltar government externally, and was asked by the then Chief Minister Joe Bossano who is today the minister of economic development, to ensure that we caught up with these over 100 directives.

I put a team together from my firm and recruited a consultant, a man called Sir Peter Graham QC who had retired as chief parliamentary draftsman in England, and with his help and the team of young lawyers that we had here, we caught up with practically all the directives on everything from GMOs to company directives and insurance and the mutual assistance directive. There were a lot of problems. Twenty-seven directives covered things like rivers and streams, the nationalisation of the steel industry and the coal industry, so I gave an opinion on behalf of the Gibraltar government saying that we neither have rivers nor streams, and we never had a steel or coal industry so we never nationalised them, and in this way I got rid of 27 directives in one opinion.

Then we had some directives that were drafted in such a way that Gibraltar was uncovered, so I had to find a way to ensure Gibraltar was somehow covered. One example is the mutual assistance directive. In the schedule, it lists all of the tax authorities in Europe such as the commissioners of the Inland Revenue, the relevant German tax authorities, and so on. Gibraltar wasn’t included there and we are a separate tax jurisdiction, so we had to find the way in which to bring Gibraltar in, even though we were not named in the directive.

The main thing we had to do was to bring the financial services directives in: the anti-money-laundering directive, the insurance directive, the financial services directives. And we managed to do them all. That took us about eight years, and we were the first British offshore territory to adopt anti-money laundering legislation. This was then used as a blueprint for the other territories.

“We were the first British offshore territory to adopt anti-money-laundering legislation. This was then used as a blueprint for the other territories”Tweet This

TRC: What was your role in the growth of the gaming industry in Gibraltar?

JL: I acted for Ladbrokes, who were the first gaming company in Gibraltar and a household name. They asked for exclusivity for two years, which they got, and then all the major companies followed and Gibraltar’s policy was only to accept top gaming companies. I saw great potential there. It was important only to deal with household names and that’s what Gibraltar did, so whilst Malta has hundreds of licenses, we have a limited number because only the major players have been allowed into Gibraltar.

TRC: How has that benefitted perceptions?

JL: It’s been very positive. We’ve done the same with banks. We’ve only let the right sort of banks come in. We were very exclusive in gaming, and I was the one who brought the first gaming company in, and the second and the third as well. We now do work for over 70 percent of the gaming companies at Hassans.

TRC: Which other areas of work are you focusing on?

JL: There is a lot of international property work. We have some international mining work in Africa and South America, and a lot of private client work for high-net-worth individuals. We do a fair bit of banking work and a lot of insurance work.

TRC: Where do you see the future for Gibraltar in financial services?

JL: Gibraltar is very small so it doesn’t need a shower to fill it, just a few drops. In gaming we don’t need 400 companies. It is the same in the financial sector. I think also Gibraltar is very well-placed to have headquarters of companies here for all parts of Europe. That is starting now, slowly. Gibraltar can replicate its excellent success in gaming in other internet businesses, such as distance learning, medical, all this.

TRC: Where are your clients from?

JL: I would say 20 percent of our clients are from Gibraltar and 80 percent are foreign.

TRC: What would you like people to understand about Gibraltar?

JL: It’s important to know that even the Spanish government has accepted Gibraltar banks passporting into Spain.

Secondly, I would say that Hassans is an international firm, we’ve just hired two consultants from two major firms in England and we can provide M&A services internationally, we can provide tax services internationally, we have now finished a large transaction in Africa, and we can provide services at a more competitive scale.

“Hassans is an international firm which can provide services at a more competitive scale”Tweet This