Engineer Sebbowa served as a senior lecturer at various universities in Nigeria, Kenya and Uganda until 1991. In the nineties, he served as CEO of a Ugandan manufacturing company before taking on the top role at the country’s electricity regulatory agency. Today, as executive director of the Uganda Investment Authority, he is tasked with getting the word out about what this East African country has to offer investors. The Report Company met with him to find out more.

The Report Company: How would you describe your strategy for investment promotion?

Frank Sebbowa: We are refocusing. In the past we used to go out to conventions, we would have missions and people going out to other countries, but we are now targeting specific investors who we suspect are interested in Africa. We go mainly for those we think have an interest in Africa. We know for a fact that the Americans have begun to take more of an interest. We recently had a delegation of potential American investors and this has not happened for a very long time, for people to come from America and see what opportunities we have here. As far as I am concerned, now is the time for us to start looking in the American direction.

People must know about you. Africa is 54 countries and if they know about the first ten and you are not in them, maybe you don’t count, but then there are many things to do to be counted.

“As far as I am concerned, now is the time for us to start looking in the American direction.”Tweet This

TRC: Why should investors choose Uganda?

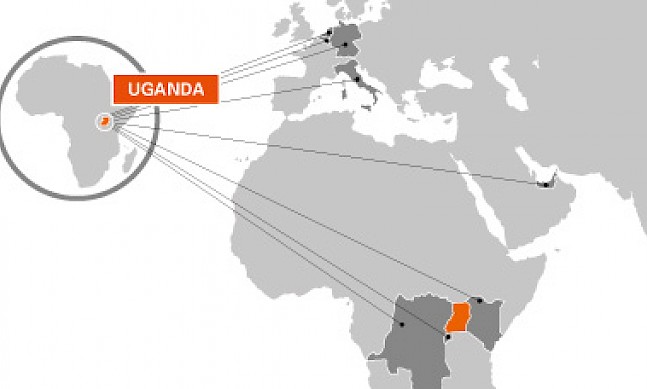

FS: Uganda is the third largest economy in the East African Community and has been the second preferred location for foreign direct investment for more than five years now. More importantly, Uganda is at the centre of the East African Community, making it a hub for business and a gateway into central Africa. Uganda is the right place to be. Our commitment to investors is bigger. Kenya had a head start on all of us; when we had our political issues in the 1970s, Kenya was moving ahead, therefore we can’t compare with them in that way. However, we have identified a few key areas where we think we should focus on for investors. These include ICT, minerals – new geological maps indicate a number of mineral commodities have been explored to sufficient detail, so there has been significant increase in the known mineral resource base of the country – and then we have our agro-processing. The arable land we have here in Uganda offers the most viable opportunity in the EAC considering our rains twice a year and the fact that only a third of the arable land in Uganda is under cultivation. These are the reasons why investors should be interested, along with the commitment of the government to the investors. We led the East African negotiation for the American protocol to protect American investment in the region.

TRC: What could Uganda have done to take better advantage of the African Growth and Opportunity Act (AGOA)?

FS: One of the things we were focusing on was on stabilizing the region. You may find that we did not give enough attention to the products that were going into the AGOA regimen, but we have sorted out our issues so next time around we will be ready. We did participate but not sufficiently. We did not finish our quotas, we know that. We should have reached all the quotas that were available. We were focusing more on long-term sustainability and if it is renewed again we will probably take better advantage.

“Uganda is ready for fresh investment. We see a hefty inflow of investment from the East and the Far East and we would like this to be balanced by investment inflows from the West because it is important to diversify where your investments come from.”Tweet This

TRC: What can Uganda do to address its trade deficit?

FS: One factor in that is that, in the past, most of our products, both in agriculture and minerals, were taken out of the country in their raw form. We need to reduce that and start exporting finished products. On the imports side, there are many basic things coming out of Asia which could be locally produced here so we are trying to motivate local people to do import substitution. The other aspect is financial discipline to reduce how much we spend and look at what we spend money on.

TRC: What projects do you have in place to promote local producers?

FS: As an institution, UIA trains local producers for free to improve on their quality, what they produce and their quantity, and we link them to the multinationals that are in the country. Tullow Oil for example used to import most of their food for their expatriate staff, but by linking them with our local SMEs in that, they now get almost 80 percent of their food requirements locally.

TRC: What are your objectives for the agency?

FS: I think this agency should be an effective one-stop center for investors and should be backed by law. I know government is working on this and I am part of this. The government is now deeply involved in reviewing the law to see how the one-stop center plan will work. We also want to put in place an electronic mechanism, so if an investor is in New York and sees an opportunity in Uganda, he will be able to access the information he needs to make a decision from his desk. This is crucial because it will become our cheap but very effective window to the world.

TRC: What would you like investors to know about Uganda?

FS: Uganda is ready for fresh investment. We see a hefty inflow of investment from the East and the Far East and we would like this to be balanced by investment inflows from the West because it is important to diversify where your investments come from. We want, therefore, to appeal to our friends in the West to come and invest here. We are ready, the laws are in place and the opportunities are here.