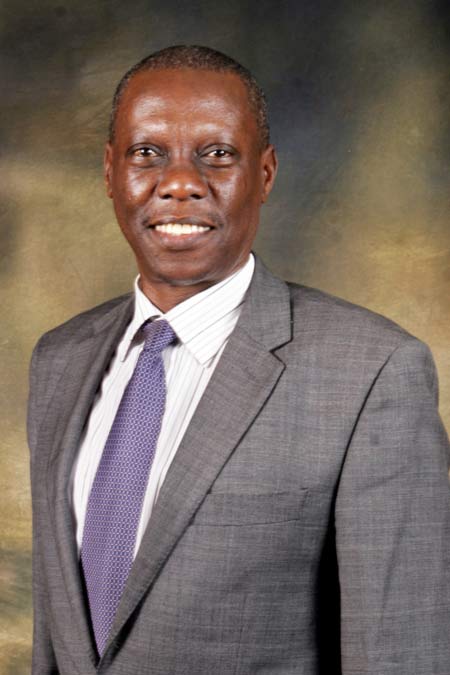

Formed during the British colonial administration of Uganda in 1952, the Uganda Development Corporation (UDC) was tasked with promoting industrial and economic development in the country. Following roaring success in the years following independence, it fell into a steep decline during the 1970s and 1980s, and was eventually wound up in 1998. Almost two decades later, it has been re-established as the investment arm of the Ugandan government. Fred Ogene, UDC’s CEO, spoke to The Report Company about the revamped corporation’s plans for the Ugandan economy.

The Report Company: Could you give us an overview of the rebirth of the corporation?

Fred Ogene: UDC was formed in the 1950s and was relatively successful in the 1960s. By the early 1970s, it was contributing a third of the funds to the national treasury in Uganda. It was the second biggest employer apart from the civil service, through its various subsidiaries. UDC was the holding company through which the various subsidiaries were managed. This included hotels, tourist attractions, cement factories, in fact almost everything. But owing to the political and economic turmoil in the 1970s and the 1980s, the subsidiaries were run down as a result of mismanagement and political interference.

In the late 1980s, there was a recommendation to privatize all of them, the assumption being that that the private sector would be able to take over and manage. Unfortunately, we never sat back to analyze whether we actually even had a private sector at that time that would be capable of taking over. With hindsight, now we know that the private sector was not yet at the stage where it was able to carry on by itself. The realization came in the 2000s that the move that was taken was probably either the wrong prescription or it was a bit premature. This realization brought back the need for the UDC.

In the earlier UDC, the investment was being done by government itself into all of these enterprises and subsidiaries. The only difference now is that we want to make investments with government, but we will do so with the private sector. The catchword is for us to be able to catalyze development with the private sector, through public-private partnerships (PPPs) or similar structures. Then, at a point in time where we think the private sector in any given enterprise is able to take over, we can then exit, either by leaving the enterprise to the private sector or making it public through the stock exchange. Obviously, again, the circumstances have changed. Previously there was no stock exchange in Uganda, so we would not have that opportunity. Now we do have a stock exchange, so there is an opportunity we can exploit.

“The UDC demonstrates that the government of Uganda intends to catalyze industrial development in this country.”Tweet This

TRC: Are there similarities between UDC and Temasek, the Singaporean government’s investment company?

FO: Ironically enough, in the 1960s Singapore fielded a team to come to Uganda and study the UDC. They then went back and introduced their own version. Today, we may now have to go and study Singapore as an example to follow. We want to look at strategies to see how best UDC can catalyze industrial development in this country.

TRC: What kinds of assets are you managing and what kinds of PPPs are you looking at?

FO: We are actually starting afresh. We haven’t inherited anything. The law that establishes UDC is only now going through parliament; it hasn’t been passed, although it should be passed by the end of this financial year. The only thing that remained of the old subsidiaries is Lake Katwe salt project.

That said, government has already made some investments and passed them on to us. We have invested in Kalangala with a few partners: Infraco, which is based in the UK, and IDC of South Africa. The government of Uganda through UDC has invested into infrastructure development in the Kalangala islands in Lake Victoria. They were very difficult to reach previously but now we’ve put in a ferry, we’re putting in electricity, we’re putting in a water supply and we’re generally opening up this African paradise to the world. We are also doing a fruit factory in Soroti, which will be producing orange and mango juice. There are quite a number of other projects that are still on the drawing board.

“We are not going to be a charitable institution. We are a moneymaking institution. The basis for which we take on a project is that it must be able to have economic returns. Of course, a project may also have social returns, but that will not be the overriding factor.”Tweet This

TRC: How much freedom do you have to decide on which investments to make?

FO: The beauty of my job is that we are not going to be a charitable institution. We are a moneymaking institution. The basis for which we take on a project is that it must be able to have economic returns. Of course, a project may also have social returns, but that will not be the overriding factor.

If our end game is to make sure that the private sector buys into this project and takes on, or if our end game is to be able to list this project on the stock exchange, we have to ensure that there is a positive economic return on investment.

TRC: How do you see the development of UDC over the next five years?

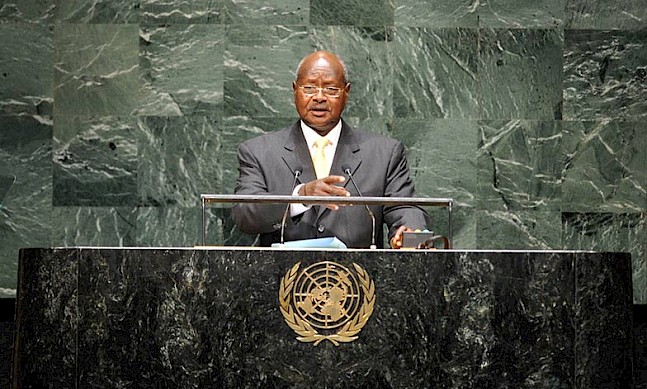

FO: The biggest threat to the progress of UDC would be for us to remain as part of government. The bureaucracy of government is a killer in respect to going into the business world. But if we have a board of our own and we get capitalization and don’t have to rely on government releases, then we should be able to move as fast as we need to. We must be able to match the speed and the thinking of the private sector, otherwise the UDC will be a non-starter. The president is very clear about where he wants UDC to be going and the autonomy that it must have.

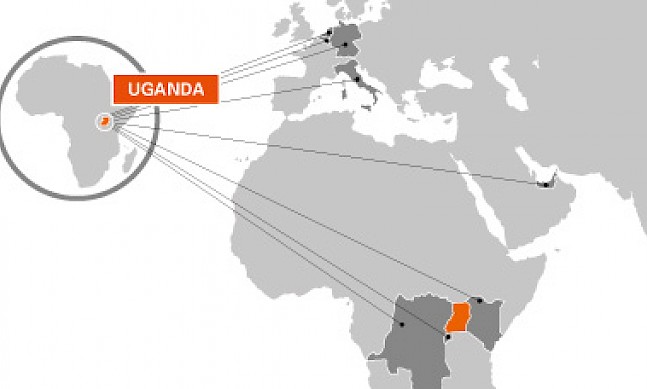

TRC: How do you want UDC to be perceived abroad?

FO: I think the UDC demonstrates that the government of Uganda intends to catalyze industrial development in this country. We need to turn around our trade deficit, which is very bad. The only way we can do that is by undertaking manufacturing in this country. We, as a government agency, are open to investment from partners and friends out there. We think this is a virgin area in terms of investment. Many of the projects we have so far touched have a positive economic return and so we invite people to come and partner with us.

TRC: In which areas do you see potential?

FO: We need to break the cycle of solely exporting primary products and instead export products which have added value. The most obvious example of this would be in the agricultural sector, but we are also looking at areas in the iron ore value chain. The mandate we have covers the whole of manufacturing. We are currently working on a project for the manufacturing and assembling of vehicles. We have partnered with Makerere University in an innovative electric car which we are looking at commercializing, so we hope to be in a position to start manufacturing automobiles in Uganda.

TRC: How do you want to run the corporation?

FO: We’ll have management, which will be the holding company. Then we will have a board of directors, which would be the policymaking organ of the operation, then each of the subsidiaries will have their own management, to which this holding company of UDC will appoint directors. We will not be micromanaging these subsidiary companies. They will be companies in their own right, but with the shareholding of UDC and any other person with whom we will have gone into business. That will be the style. We are not experts at everything. There are experts who are best qualified to run those industries and sectors, and we want to partner with them.