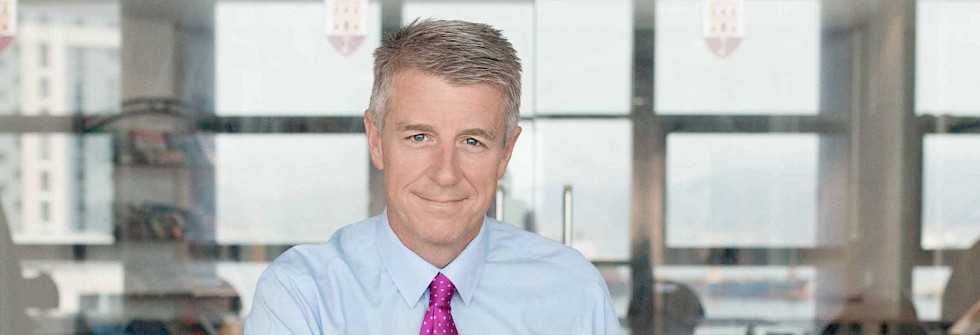

Already a well-established financial services destination, Gibraltar is now a full-service jurisdiction, following the establishment of its first stock exchange. GSX, which began full operations in the fourth quarter of 2014, offers open-ended collective investment schemes the opportunity to achieve visibility throughout the EU via a listing on the exchange, and in the near future plans to expand its offering to other structures. Nick Cowan, GSX’s MD, explained to The Report Company the significance of the new stock exchange to Gibraltar, and how he sees its evolution.

The Report Company: What is the importance of the new stock exchange to Gibraltar?

Nick Cowan: Prior to the opening of GSX, Gibraltar was the last EU jurisdiction that didn’t have a stock exchange. Being part of the EU, there is a fantastic opportunity that Gibraltar needs to exploit further in order to elevate its standing in financial services.

When you’re competing with jurisdictions globally that have stock exchanges, it becomes quite difficult for you to provide economies of scale in providing a single solution. The challenge for the jurisdiction is to position and promote itself as an attractive service provider within the EU.

When we set out, we wanted to make sure that we opened an exchange that was fitting for the jurisdiction, relevant and relative to the services which it specialises in, and low risk. Failure wasn’t really an option. We came up with a strategy, working with the regulator and government, that we would open an exchange in the simplest format possible: a listing exchange for funds. Then once we were open, we would then grow together as a jurisdiction, taking into account the risk appetite of the regulator.

TRC: Why did you choose to list funds first?

NC: Firstly, there has been a funds regime (the experienced investor fund) in Gibraltar since 2005 and therefore there is a deep knowledge base and level of expertise currently in place. Secondly, it was as a result of the onset of regulations in the EU, particularly the alternative investment fund managers’ directive, or AIFMD. This directive protects our investors by ensuring that alternative investment fund managers are appropriately licensed if they wish to market their services to investors in the EU. Ultimately, you have to come onshore. The EU no longer wants a manager in Hong Kong, for example, to be able to promote their alternative fund to EU investors without being regulated here.

AIFMD was first introduced in 2013 and currently is set to be fully implemented by the end of 2018, by which time you really need to have sorted out an EU presence in order to access EU investors. As a result, Gibraltar went from being one of 20 fund jurisdictions globally to one of four in the EU, which has been a large factor behind Gibraltar increasing its profile globally. Luxembourg and Ireland are the two big jurisdictions in the EU for the funds industry, and Gibraltar was obviously always very small compared to them, but now it has the opportunity to grow its business. Gibraltar is now actively saying to fund managers that it is open for business.

The problem is that a large number of institutions can only invest in listed funds. A large number of transparency disclosure requirements that investors are demanding require more and more funds to be listed. Two things, therefore, have happened post-crisis. One is this macro-drift from non-EU to EU because of AIFMD. The second is a global drive to listing, because investors are demanding more transparency.

That was the strategy behind our initial offering and now allows Gibraltar to market itself globally as a competitive jurisdiction that can provide structuring and listing solutions within the EU.

With our offering defined, we have to ensure that we can differentiate ourselves from other jurisdictions. Ireland and Luxembourg are the biggest jurisdictions in domicile, and the biggest jurisdictions in listing funds, but due to their size, they understandably focus on the larger rather than smaller funds. Gibraltar meanwhile is very much the home of the smaller entity. We want to provide services to the smaller fund manager. We have to be faster to market and provide services at a lower cost than the competition.

TRC: What size of fund are you targeting?

NC: Something like 80 percent of Asian fund managers are managing less than $100 million. Sixty-five percent are less than $50 million. It’s an enormous tail of people like me, who once worked in investment banking for example, but due to the changing nature of that industry have decided to leave and set up their own hedge funds. We see our benchmark as sub $50 million. In fact, the first fund that’s listed on GSX is $4.5 million under management. Lyford Global is a small fund, but what they wanted to do was to raise their profile and visibility by listing on an EU-regulated exchange. The speed and the price at which Gibraltar managed to bring the fund to market, no other jurisdiction could hope to compete with. That was the key, to make sure we do things differently but efficiently.

TRC: What are you doing to market the exchange?

NC: We’ve been travelling extensively since we started the business three years ago, spending time in the US, Asia and Europe. For example, we have been to Asia three times this year and we are going twice more times before the end of 2015. In July, in conjunction with the government of Gibraltar, GFIA, the FSC and GSX travelled to Hong Kong and Singapore, where we held two seminars focused on the role Gibraltar can play in helping non-EU funds market themselves in the EU. One hundred clients in Singapore and 200 in Hong Kong attended our technical workshops followed by a lunch hosted by the minister for financial services, Albert Isola.

With seven percent of the world’s population but 25 percent of the world’s wealth, the EU matters. The reliance on reverse solicitation in Asia to access EU investors, or simply doing nothing, is a recurring theme that is not a long-term sustainable model. Gibraltar can help alternative fund managers who are not in the EU, with EU solutions, be it AIFMD passporting, NPPR and/or listing on GSX. For those managers unsure what to do regarding the EU, a listing on GSX can give you the visibility which may facilitate the longer-term decision to establish an onshore presence.

These types of flagship events are a vital part of Gibraltar plc’s commitment to marketing our capabilities, and we will be back again in October to follow up on the immense response we received.

TRC: What does your listings pipeline look like at the moment?

NC: We are currently reviewing around fifteen potential listings which should be completed during the next few months. We only list open-ended funds at the moment, although our closed-end code is complete and we hope to start listing closed-end funds in October. I’ve just finished drafting our third code, which is for debt, derivative and asset-backed securities, which we also planning to commence listing from 1st October. Asset-backed securities or exchange-traded instruments (ETIs) provide an innovative alternative to AIFMD, and GSX expects to see this business grow. We have also altered our members’ code, permitting access to applicants from outside Gibraltar but within the EU. An expansion of our members and our product lines will facilitate our growth plans.

TRC: What makes GSX unique?

NC: The first thing that makes us unique is being based in Gibraltar. We are a small jurisdiction in size but not ambition. If you look at our services in sectors such as e-gaming and insurance, we are a world leader. In Gibraltar, we work very closely with our regulator, which has facilitated a robust yet responsive control environment. We work closely with Gibraltar Finance, the government’s marketing arm for financial services. And we have excellent member firms that are leaders in their fields. This co-ordination and collective ambition is a potent combination.

Specifically focusing on GSX, we are unique for a number of reasons. One is being the fastest and the lowest cost to market. When we drafted our listing code, we adopted a philosophy of disclosure and transparency rather than creating an additional regulatory regime. If you are an open-ended fund, you are based in one of our approved states, and you can demonstrate that you have the required experience, you can apply to list on GSX, whether you are a start-up or an established fund. By having a code that’s sympathetic to a fund’s existing offering document, our member firms have the ability to draft something with ultimately lower legal fees. We are not going to make you change your depository, impose leverage restrictions or insist on investment diversification; what we insist on instead is that the manager discloses everything in the listing particulars for full transparency.

Faster drafting leads to lower costs, enabling ease to market. Once GSX has reviewed the documents submitted by the member, we submit to the listing authority, who have a ten-day turnaround time in which to ask questions. If they ask a question, they have a further ten days to either admit or decline admission. Funds listing on GSX are able to come to market at a speed and a total cost that is competes favourably with other jurisdictions.

The second thing we’ve done is establish a growing distribution list for our newsletter including the largest EU fund distributors. All subscribers to our newsletter are notified every time there is a new listing. When someone lists with us, they get visibility across the EU, and the globe.

The third thing we have is GSX Connect. GSX provides a connectivity platform that allows registered users to connect with managers listed on GSX, When you register, you have to go through a disclaimer process where you confirm that you have not been solicited. When an investor contacts a manager through our portal, an audit trail is created.

TRC: What’s the exchange’s contribution to awareness about Gibraltar as a financial centre?

NC: The Z/Yen Group stated in one of their surveys that without an exchange, Gibraltar was underdeveloped compared to other jurisdictions. I think any financial centre without the ability to provide capital market services will operate at a disadvantage. GSX has a significant role, and therefore responsibility, to play in developing Gibraltar as a capital market. Two years ago, I don’t think we would have had 20 people from Gibraltar going to Hong Kong and Singapore hosting big events for a room full of 200 fund managers who have come because they want to hear about Gibraltar. The exchange doesn’t take any credit there but what the exchange has done is created a reason. It’s created a catalyst for us as a jurisdiction to go out there and say, we do things differently, we are open for business and that other jurisdictions’ small clients are our big ones. Certainly for that smaller manager, we really have something to tell them, which is that if they are considering a European solution, there’s another drawing pin on the map.

TRC: What is your outlook for the short to medium term?

NC: I think Gibraltar really has a very exciting three years ahead of it, not just because of GSX, but the regulatory changes, the government that’s in, the enthusiasm that is there, the resources they are ploughing into raising the profile globally, and the fact that we’ve got ten member firms who probably didn’t go far beyond London but that now are travelling all over the world. We have a very exciting story here that people need to know about.

“We make it very easy to come to market but in a robust, controlled environment with well-managed risks”Tweet This