Photo: ANRT

Photo: ANRT

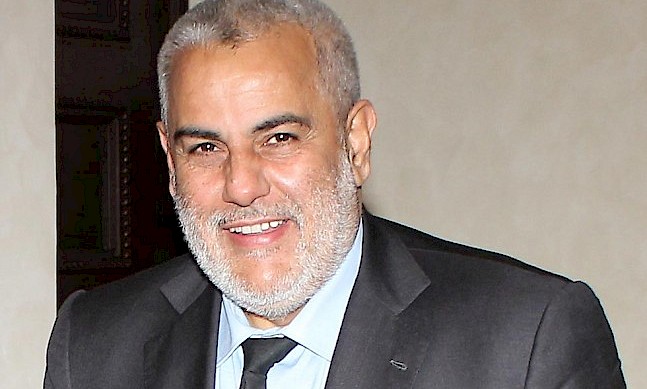

As well as regulating the telecommunication sector in Morocco, the National Agency of Telecommunications Regulation (ANRT) works to promote fair competition and innovation to ensure the industry remains at the cutting edge. Azdine El Mountassir Billah, its pragmatic and insightful director-general, took up his role in 2008 and sees the evolution of the communications sector since then as a key enabler for rural and urban development. He spoke to The Report Company about the projects the agency currently has underway and the role it plays in national and regional development.

The Report Company: What have been the major developments in the telecommunications sector since you came to the ANRT in 2008?

Azdine El Mountassir Billah: There have been many positive changes since 2008. At that time, Morocco had a few hundred thousand ADSL subscribers at quite high prices and a mobile usage rate which, compared to that of the European countries, was extremely low.

We released strategic guidelines for the development of the sector between 2008 and 2013. Our primary concern was widespread access at the national level. Our second concern was to lower prices significantly. Finally, we wanted to address the constraint of the low number of fixed lines – just 1.2 million – in developing the internet.

According to our plan, by 2013 we expected to have 32 million mobile users and two million internet subscribers, and a decrease of 40 percent in prices. The result was actually that today we have a mobile penetration rate of 130 percent with 44 million subscribers, and prices have fallen by nearly 75 percent. Equally, the number of internet subscribers has grown exponentially, reaching today more than 11 million, versus the two million by the end of 2013. This spectacular growth has been made possible thanks to the development of mobile internet access; in fact, 90 percent of internet subscribers use their mobiles. The only negative indication is the decline in operator revenues, which have fallen by almost three billion dirhams ($300 million) during this period. Effectively, the growth in mobile voice services (from 10 billion minutes in 2008 to 48 billion in 2014) hasn’t been able to compensate for the fall in prices.

During the same period, we launched a project to cover the most remote rural areas of the country, through a public-private partnership model. The reason for this approach is to ensure that the state, which decided to liberalize the sector and open up to the private sector the majority of the capital of the incumbent operator, could respond to the needs of the population throughout the whole country, without having to get involved itself as an operator.

We have therefore launched calls for projects with operators; we engage them to cover non-profitable zones through subsidies that we provide via the universal telecommunications service fund. Thanks to this fund and the $140 million it has provided over the last four years, we have succeeded in providing telephone service coverage to 9,300 small villages and around 2.3 million people, with a commitment to maintain the service for 10 years. This encourages operators to go into remote areas and allows us to cover them. It’s important to remember that 48 percent of our population lives in rural areas.

“Business practices are different from in Europe. Moroccans do their grocery shopping every day, and the telecom product is included in their daily shopping basket. This is a culture whereTweet This

we only consume what we have paid for”

TRC: The government has laid out the objectives to be met by 2018, which include 50 million mobile subscribers, two million fixed-line subscribers and 22 million internet subscribers – nearly double today’s figure. What is your strategy to meet these goals?

AMB: The strategy was made public as part of our strategic guidelines for the development of the sector up to 2018. The National Broadband Plan, launched in 2012, aims to expand internet access of a minimum of 2Mb/s to 100 percent of the population by 2022.

We have just awarded 4G licenses to operators and the service is already active. The tender specifications for these licenses include an obligation to cover at least 65 percent of the population over a period of five years. As part of their response, some operators have committed to covering more than the minimum requirement.

Coverage for a further 25 percent of the population will be provided via mobile technology (3G/4G) through calls for projects that will bring in global operators according to the same principle of a public-private partnership. The winning bids will be those which respond to technical criteria and provide coverage with the lowest public subsidy. Operator infrastructure sharing will be encouraged within the framework of these projects.

The remaining 10 percent of the population will probably be covered by satellite solutions offering community internet access and ensuring coverage of vital public services in the most remote and sparsely-populated areas.

TRC: Given that the mobile market is still mainly pre-paid, in contrast to European markets which tend to be mostly post-paid, what does this mean for the sector in Morocco?

AMB: Pre-paid clients represent 80 percent of the market. It is difficult to make analogies between the Moroccan market and the European markets because they function in two entirely different ways. For example, in France and Spain, 100 percent of the population has access to banking services, while here in Morocco that figure is more like 60 percent.

What’s more, the way the household budget works is different here. Business practices are different from in Europe. Moroccans do their grocery shopping every day, and the telecom product is included in their daily shopping basket. This is a culture where we only consume what we have paid for.

This has a large-scale impact on commercial business models. I always give the example of rural electrification, which was quick to switch to the prepaid model with rechargeable cards used to top-up the meters.

TRC: What measures are you taking to support commercial innovation given this environment?

AMB: I think we should put the impact of the business model on operator investment capacity into perspective. The proof is in the ongoing investment that they have been putting into the sector over the last more than a decade. Effectively, each year the three operators invest between five and six billion dirhams to meet both market growth as well as the evolving technological needs of the sector. This investment represents between 15 and 18 percent of turnover, which is the international standard. In fact, the operators have more to fear from the impact of OTT (over-the-top) applications. The Moroccan telecoms market continues to rely on voice billing, while OTT applications are beginning to offer this service for free.

“We cannot develop and diversify our economy without the contribution of our partners in the North thanks to the outsourcing business we get from them, or without helping our partners in the South to build capacity.Tweet This

We intend to work in partnership with the entire region”

TRC: What can you tell us about the bill which intends to give the ANRT more power, more independence and more autonomy? What is the thinking behind this and what impact will it have on the sector?

AMB: The bill has three components. The first focuses on the clarification of the contractual relationship between operators and clients. We have an increasingly more sophisticated market while the client is often poorly informed. The regulator will have the ability to intervene if necessary to ensure transparency in commercial relations between operators and clients. At ANRT, we are currently focusing on consumer protection. It’s an important aspect especially taking into account the variety of services that can all be provided by one single operator.

The second component, which we have been working on for the last few years, is infrastructure-based competition, where each operator deploys their own infrastructure, competition prevails and this gives commendable results. We are going to reverse this policy now, and move to infrastructure sharing, because the volumes are ever larger and we are at a level of competition which allows for optimal results from infrastructure sharing.

The third component looks at a number of fines for operators, where the regulator has to file court proceedings in order to impose financial penalties. For reasons of speed, we have proposed that rather than going to a tribunal, this process should be overseen by an internal committee of the agency, a judge, two experts and the director-general of the agency. The operator will still have recourse to legal proceedings in case of an appeal.

All of these elements are on the agenda because the sector moves very quickly. The proposals of this bill will give the regulator flexibility to accompany the growth of the sector.

We’re not looking for more autonomy vis-à-vis the state, because the state has never had a role to play in matters of regulation. The state’s role is further upstream, in terms of setting government strategy for the sector. When it comes to arbitration and handling issues in the sector, the state remains outside of these decisions, particularly since it is a shareholder of the incumbent operator.

With all due modesty, we have followed an innovative governance model since the ANRT was created in 1998. This model brings together the presence of the government, the independent administrators and an autonomous management and ensures that all issues in relation to the executive are dealt with by the agreements in place.

By giving necessary autonomy to the regulator, it will be able to act on matters of competition, on operator service portfolios, and so on, all while being a tool of the state to carry out public policy. In practice, we hand out licenses and we create competition through business models, enabling the state to receive variable royalties based on operator turnover.

“Enabling millions of people to be connected, bringing them together as part of the wider world, allowing them to become less isolated;Tweet This

you can’t put a price on that”

TRC: What is your view of Morocco as a knowledge hub, and how would you appraise its human capital capacity?

AMB: The ANRT is active on many levels. First of all, we manage one of the best engineering schools in the country, the INPT. This school trains engineers in information technology and telecommunications. Each year, there are between 200 and 220 diploma recipients, and this enables us to maintain contact with the market and produce graduates with the relevant skills for the sector.

We have also created what we call a “soft center”. This is a small R&D center, and we are currently focusing on building ties between the small start-ups based at the Technopark in Casablanca and contractors for the administration and the banks in order to develop mobile applications, all with the participation of the young graduates. We have placed between 120 and 140 young people.

We also do a lot in terms of cooperation in Africa and we get a lot of requests from regulators in the francophone countries there. We organize two or three conferences at our own expense for their executives; we give them a week’s training on analytic accounting, bid evaluation models, management of spectrum frequency, and so on. To support this training, we have just opened the engineering school to officials from African countries. Each year, we welcome 20 people from 10 different countries who will then leave with an engineering diploma.

We cannot develop and diversify our economy without the contribution of our partners in the North thanks to the outsourcing business we get from them, or without helping our partners in the South to build capacity. We intend to work in partnership with the entire region. The idea of a knowledge hub isn’t simply a notion; it’s a tangible concept which is taking shape in the private sector especially, in areas such as telecommunications, insurance and real estate, but also in the public sector.

We have also launched a call for projects between now and the end of 2015 at the administrative level to roll out e-government initiatives to rural areas that are not currently connected to the internet. We have made a commitment to cover the cost difference between normal internet and the more expensive satellite internet connections for three to five years. The aim is to increase the use of new technology, help the sector to growth and also provide leverage for the public sector.

TRC: How would you appraise the ANRT’s relationship with the three operators?

AMB: ANRT doesn’t drive the sector forward; the operators do. We are there to support them and give them as much visibility as possible. We act indirectly on the market, we promote exchanges, consultation and dialogue among operators but we are firm on the application of the law within the framework of an ongoing dialogue.

TRC: What are you most passionate about in your job?

AMB: Everything. This is my first post in the public sector; I’ve spent my entire career thus far in the private sector. The difference between the two is that in the private sector, our actions only impact upon the company and its clients – it’s a much smaller sphere. In the public sector, we are acting for the entire population. Enabling millions of people to be connected, bringing them together as part of the wider world, allowing them to become less isolated; you can’t put a price on that. Anecdotally, an MP from a rural area even told me that more people are asking for internet connections than they are roads.