Tasked with safeguarding national finances and developing long-term strategies, the Bank of Uganda is proactively tackling diverse challenges.

The Bank of Uganda, which ensures national economic stability, was formed in 1966 by Parliament. Its board of directors is overseen by a governor and vice-governor, both appointed by the Ugandan president. Along with guiding monetary policy, the bank controls nine currency centers across Uganda.

The Bank is also involved in important international policy movements. It was among the original 17 regulatory bodies to commit, in 2011, to the Maya Declaration’s vision for ‘financial inclusion,’ during the Alliance for Financial Inclusion’s Global Policy Forum. The bank is thus committed to providing increased access to banking for the poor, improving customer protection and similar practices. The Bank of Uganda is thus taking a leadership role in developing economies.

The bank has also maintained price stability and kept the financial services sector sound, while enacting investment-friendly monetary policies such as extremely low restrictions on capital inflows and outflows. And, during the global financial crisis, it preserved a sound financial environment, insulating Ugandans from trouble.

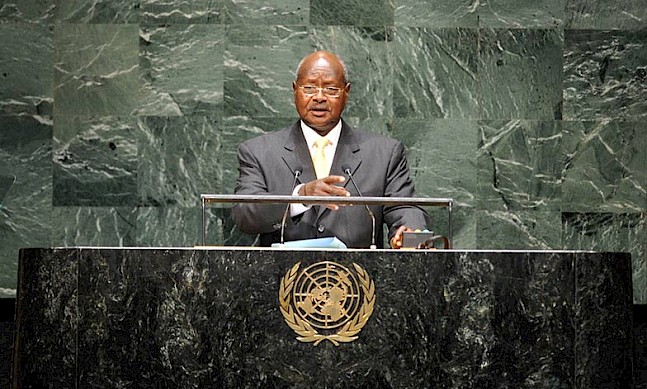

“The most important role banks and financial institutions can play to support development is channeling credit to the business sector.”

Emmanuel Tumusiime-Mutebile Governor of the Bank of Uganda

Tweet ThisHowever, Uganda, and much of Africa, is now afflicted by a challenging macroeconomic climate. The Ugandan shilling has depreciated by 24.5 percent since March 2014. Nevertheless, the bank’s experienced governor is confident. Emmanuel Tumusiime-Mutebile notes that Uganda survived inflation in 2011. “We strengthened our monetary policy framework,” he says, referring to Uganda’s ‘inflation lite’ targeting framework. It allows for “adjusting interest rates on the basis of inflation forecasts.”

According to Tumusiime-Mutebile, this reform became “a much more effective policy tool to dampen inflationary pressures before inflation increases too rapidly above our medium term target of five percent.” Because of this new system, says the governor, “I am confident that we will not see a repeat of what happened in 2011.”

If Tumusiime-Mutebile is correct and all is well by January 2016, when he will resign following a record three guberatorial terms, it will be a fittingly graceful close to a remarkable career. Born in 1949 into a poor peasant family, the young man fled the Amin dictatorship in 1972, earning an economics degree in Britain. When the Amin regime fell, he returned, and since 1979 has held numerous high-level governmental positions, such as a stint in the finance ministry shaping economic policy. All told, Emmanuel Tumusiime-Mutebile deserves great credit for directing Uganda’s evolution from an African backwater marked by poverty and violence to an emerging market with a growing middle class.