Umeme is the largest electricity distribution company in Uganda, and is taking a fresh approach to the country’s power industry. Listed on the Uganda securities exchange and on the Nairobi securities exchange, with Investec Asset Management as its majority shareholder, it has led the way in attracting foreign capital into the sector. The Report Company met Selestino Babungi, the company’s managing director, to find out more.

The Report Company: You are the third managing director of Umeme, and the first to be drawn from the local talent pool. What has the company’s journey been so far?

Selestino Babungi: The role of the first managing director was to set up the company and transform it from a government institution to a private business. That was completed in 2008. The second managing director came in around 2009. His role was to turn around the company and make it viable. By the time he left, we had raised capital and we were investing in the distribution network.

What we have achieved so far is increasing connections from 280,000 customers at that time to 650,000 customers as at the end of last year. Energy losses, which were at 38 percent, we reduced to 21.3 percent last year. In revenue collection, which is always a challenge for distribution companies, we achieved around 89 percent at the close of last year. In investments, the initial target given by government was that Umeme should invest $65 million. As at end of last year we had invested $320 million in distribution infrastructure. Power reliability has greatly improved.

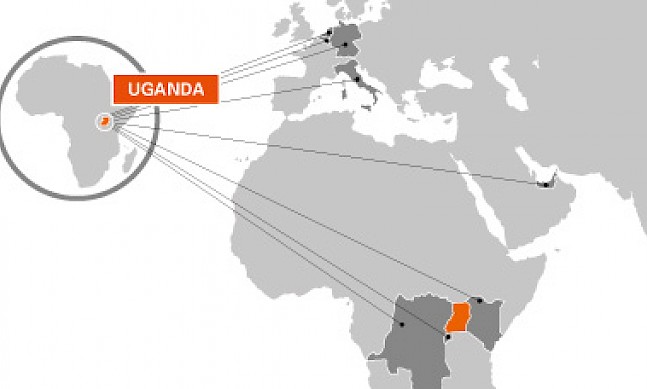

In 2013, we concluded a fundraising process where we mobilized $190 million external private capital into the country. This was funded by the IFC, Stanbic Bank and Standard Chartered Bank. The company now is really bankable; it’s delivering on its agenda and now growth is a key issue for me as the third managing director. This goes in line with government aspirations of increasing access to electricity to 40 percent of the population by 2025, from the current 15 percent.

TRC: What impact will increased access to electricity have?

SB: It has multiplier effects. Healthcare will be improved, education will improve, degradation of the environment will decrease, and even the rural households will be able to improve their economic wellbeing.

The other aspect we are looking at is industrial growth. The Karuma power project and Isimba project, which are the main hydropower projects, will bring around an extra 1,000MW in the next five to six years. Our maximum demand at the moment is 540MW, so we will need three times current demand to absorb all this power. Investment will be key over this period in substations, new lines and stabilizing supply. Mobilizing further capital will be very important. That’s the general area we are looking at and we are in cooperation with government, with the regulator, with the World Bank and with international development agencies such as KfW to see how we can make all this happen.

“Good things are coming for Uganda. When oil becomes a reality that will also be a game-changer.”Post This

TRC: What is your stance on electricity pricing?

SB: In supply, you have to be cheaper than Kenya or other countries in the region to get the investment. There is a key government agenda on the pricing of electricity. We understand the president is cautious that we may not be competitive. But we are competitive with Kenya. Eighty percent of the cost of electricity is related to generation and transmission, so investment there will bring down costs. For us as distributors we will continue to focus on efficiencies, reduce energy losses, increase access and operate efficiently.

We are targeting a six percent decrease in energy losses, the amount of power either stolen or wasted through the network, over the next three years. We see a 10 percent growth in revenue this year. That is our projection based on the economic growth and reducing losses.

The bulk of the investments that come into generation, transmission and distribution are in dollars, so consumers are somewhat exposed to that risk of currency volatility. In previous years, foreign exchange rates have been stable. In the last quarter of last year, the dollar went up and that unfortunately affects the price of electricity. The good news is that the fuel prices have come down so the fuel element of the pricing has come down.

On the industry side, manufacturers understand that for everything there is a cost. Their view is that they are more interested in availability than outages and low prices. The price should be fair enough to encourage further investment. Low pricing of electricity means that in the future the infrastructure will break down. It’s a tight balance. The power of Umeme is that Umeme can mobilize capital and deploy it everywhere across the country.

TRC: What makes Umeme so successful in terms of market share?

SB: The market is not a monopoly because there are other small distributors and local cooperatives, but the power of Umeme is that Umeme can mobilize capital and deploy it everywhere across the country. We are credible. Because of that strength, we can deliver the government’s agenda of growth, of reducing losses, and of investing in the sector.

TRC: Where do you want to take the company?

SB: I have a good understand of where the sector is and my chief focus points are on growth and access. Uganda’s electricity penetration is at just 15 percent, while Cameroon, for example, is at 50 percent. The other key focus area is on people. Umeme has a big role to play, and we need the human capital which is trained and skilled to prepare the sector.

This year we want to build two substations and a line extension. We are looking at converting around 200,000 prepaid customers, and we are looking at more than 120,000 new connections.

Umeme is unique and corporate governance is a strong point. The development of new leaders is an important item for the board. We have a very strong management team and we are now developing the next generation of leaders to move the company forward.

We have a management development program where we get the best 20 engineers and inject them into the company.

TRC: How optimistic are you about Uganda’s future?

SB: Good things are coming for Uganda. For those foreign investors who come in now, I can foresee based on the government programs at the moment that they will be ahead of the curve. Tourism is booming and the market is available. I would encourage people to take a good look at Uganda and invest. When oil becomes a reality that will also be a game-changer.