Uganda’s rapidly expanding energy sector is being driven by ambitious infrastructure projects.

It is fitting that a country as larger-than-life as Uganda should be the scene for some of the world’s most ambitious and expensive energy projects. Uganda’s energy sector is being driven by not only oil and gas, but also by massive dams and other infrastructure projects designed to harness the country’s considerable hydropower.

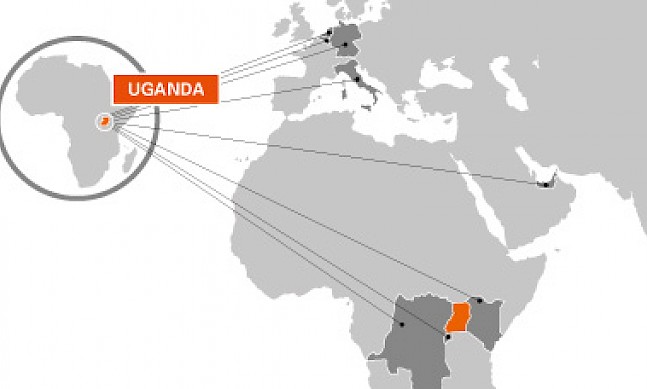

This highlights Uganda’s role as a fast-growing regional investment hub; the fact that investment has been driven by major global companies with strong presences elsewhere indicates how Uganda is entering larger portfolios.

Notable here is the Bujagali Hydropower Project, a 250MW hydroelectric facility on the Nile. It has significantly impacted Uganda’s energy security and national GDP growth, which jumped by 76 percent when Bujagali opened.

The companies behind Bujagali have found it an innovative and mutually beneficial arrangement. The first is Sithe Global, an infrastructure company and subsidiary of Blackstone Group, an American private equity corporation taking a pioneering approach to contemporary African investment.

The second company, Industrial Promotion Services (IPS), is the for-profit arm of the Aga Khan Fund for Economic Development (AGFED). Through its multi-sector development facilitation network, AGFED has had a very active and positive presence in Uganda.

Sithe Global President Brian Kubeck is enthusiastic about not only the Bujagali Hydropower Project, but Sub-Saharan Africa’s larger investment potential. Energy access here remains inadequate, inhibiting economic growth. However, Blackstone (which has $25 billion in worldwide greenfield investments) has created a subsidiary, Black Rhino, specifically focusing on Sub-Saharan Africa. For Kubeck, this investment is “a huge sign of how important Blackstone views this market as being.”

However, he adds, potential profit was hardly the main reason that Uganda was chosen for the Bujagali project. Uganda matched their selective criteria by having “good rule of law, transparent processes and an investor-friendly environment.”

“There’s the need for broad and strong support for a project from the government, which we had in Bujagali.”

Brian Kubeck Sithe Global President

Tweet ThisFurther, given the energy industry’s strict conditions at a time when social responsibility and environmental concerns top the agenda, Sithe Global had other aspects to consider. “We offset 900,000 tons a year of CO2 emissions and that makes Bujagali the largest renewable clean development mechanism (CDM) project in Africa. It also makes Uganda stand out, in that 90 percent of its grid is sourced from renewable energy, which is something that not too many countries can say. At the same time, we reduced power costs in Uganda by 66 percent the day Bujagali came online.”

Bujagali’s success is viewed as a blueprint for the future. The energy project was completely funded by private capital, but executed as a public-private partnership model (specifically, the Build-Operate-Transfer project). In 20 years, the government will take back the dam for a symbolic $1. The extremely well-built structure will certainly last much longer, though.

The successful project proves Africa is not immune to private capital, despite a difficult track record. As Kubeck notes, Africa generally “has had access to public financing and donor financing, but not big sums of private capital.”

While the Ugandan government alone certainly could not have afforded the $900 million it took to build the dam, the public-private partnership model helped make the deal attractive to both sides. “The PPP model enables you to get projects off the ground that the private sector alone would not do and that governments alone would never be able to do.”

Sithe Global also set aside $14 million for projects dedicated to Ugandans living near the dam, including schools, health clinics, job training and access to safe water supply. This focus exemplifies Ugandan leaders’ resolute determination to see investors pay in for improving people’s standard of living.

The government is now working on similar impressive energy infrastructure projects. Two more dams (Karuma and Isimba), are underway (with Chinese investors) to further increase generation capacity. Isimba Dam, to be completed by 2017, will cost $570 million and is based on the Nile, only 40km from Bujagali. It will increase Uganda’s electricity capacity by 23 percent, while creating 1,000 jobs. The Karuma Dam, located at the eponymous waterfall on the Nile, has been planned for two decades. It will become Uganda’s biggest power plant when finished in 2018.